Corsicana First National Bank - Currency || First National Bank Collectables ||

First National Bank Photos & Post Cards

Reprinted from the Navarro County Scroll, 1971

Prepared for the Bank's 100th Anniversary Celebration By: Herchel Stephens (The following presentation consists of excerpts from the first draft research paper prepared by Herchel Stephens, instructor of journalism at Navarro Junior College and presented in capsule form by Stephens to members of the Navarro County Historical Society at its August 1971 meeting. The city of Corsicana was just a village of 800 people marking the northern terminal and gathering point for supplies of the Houston and Texas Central Railroad Company (later merging with the Southern Pacific Lines) when the parent bank of the First National Bank was being organized in September of 1871.

Actually a year earlier the first bank was established in Corsicana and Navarro County as Adams and Leonard. Until the opening of the small private bank in 1870, people used all types of depositories in which to keep their money, including trunks, drawers, bedding, and occasionally burying boxes containing the family treasure. Much of the buried treasure was forgotten and eventually became permanently lost, but after the establishment of Adams and Leonard on the corner of Fourth Avenue and Beaton Street, most people began to place confidence in banking and did away with their "primitive banking" methods. This confidence was further exemplified by Captain James Garitty, one of the most romantic and colorful bankers who became a legend in banking business. An associate of Adams and Leonard, the Captain became the organizer and first president of The First National Bank, a general banking business with prompt and careful attention given collections. Born in Dublin, Ireland on April 3, 1842, Captain Garitty spent his earlier years in New Orleans, receiving what little formal education he had in the city's schools until the Civil War broke out. Like many other youths of his time, he joined the Confederate cause, enlisting May 4, 1861. The New Orleans Company soon became a part of the Fifth Louisiana Regiment which operated in the Army of Northern Virginia. Captain Garitty entered the regiment as a private but was soon promoted to captain of artillery. He fought in all the military skirmishes involving the Army of Northern Virginia and was captain of artillery at the famed Battle of Lookout Mountain in Tennessee. [error, see notes below] It is reported that a plaque in the Lookout Mountain Battlefield, now a national military park, bears the name of Garitty for his efforts. He was wounded in combat three times (Shaprsburg, Malvern Hill and Fisher's Hill) but never lost much time from active duty. When the Civil War drew to a close, Captain Garitty returned to New Orleans and worked one year as a clerk for Sibley, Guion and Co., a cotton brokerage firm and operators of the well known Guion Line of Ocean Steamers. Not satisfied with his job, he came to Texas in the fall of 1866. For the next few years, Captain Garitty relied on his clerk traineeship to get positions in the Gaining his first banking experience at Adams and Hearne Bank at Bryan, Captain Garitty moved to Calvert when the terminal point of the H&TCR reached there in 1870. To continue his banking interests Captain Garitty became a partner in the banking business of Adams, Leonard and Co., but it was here that he met Joseph Huey, another man instrumental in Navarro County banking history. Huey was engaged in the tin, stone, and hardware business and the two men formed a lasting friendship. By mid-summer of 1871, when the railroad reached Corsicana, Huey relocated in the new city in the same business, which he continued until 1879. Huey soon realized that Corsicana would be a good place for a bank and wrote the Captain to come from Calvert. Heeding the call, he sold his interest in Adams, Leonard and Co., and came to Corsicana with $10,000 to form a partnership with Huey that started a strong financial and pioneering banking institution in Corsicana and Navarro County. The pioneer banking institution first established by Garitty and Huey was formed as the private banking house of Garitty, Huey and Co., opening for business in Corsicana in Sept of 1871. Garitty immediately began to form a strong banking house, ruling with an iron hand following his election as president and serving in that capacity until his death 53 years later. Huey continued to assist the Captain as vice-president, but devoted most of his time to his hardware business. The six other original stockholders were W. R. Bright, Louis Cerf, Edmund Raphael, Charles H. Allyn, Alexander Fox and S. A. Pace. Corsicana's "Big Four" of the era were Garitty, Huey, Allyn, and J. E. Whiteselle, who later became a large stock-holder and a director. He was a son-in-law of Huey. The four, life-long friends, had a vision of a million dollar institution. The dream did not become a reality, but too late for the banker's organizers to see its capital reach a million on Tuesday, January 14, 1930. The First National Bank nationalized on July 1, 1886, becoming the first bank in Corsicana to be chartered as a national bank. The bank had a capital stock of $100,000 which was increased the following year to $125,000 and a surplus of $75.000. Captain Garitty was a Czar banker but constantly concerned with the welfare of the people. He personally loaned money to those in need. In the early days of the bank his personal account was around $50,000, but by 1920 it was rumored at$75,000.

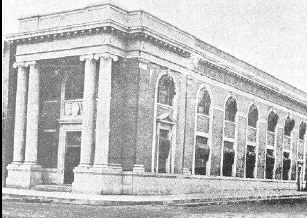

The Captain always walked home with his pockets full of quarters and half dollars to give to small boys who trailed him home. He always fulfilled a philosophy of his to give away money each day to the less fortunate. He once initialed a note for a twelve year old boy who needed to by a horse in order to get a newspaper route. The boy worked hard to keep the Captain's trust in him and paid the note out. Garitty continued throughout his long banking career to loan money to people who would pay hi back, not to people who could put up security. His theory was if a man could put up security he was not in need of help and would not bother with such loans. It is said that the Captain was the best judge of moral character, and as a result had very few loans to go bad. Of course, he did accept poor risks by standards of the bank examiners; however, if a loan was questioned by the examiners, he would write a check on his personal account and take over the loan himself. Never at any time, though, was his honesty questioned by the most suspicious examiners. Captain Garitty was always accused of running a one man bank with honorary directors. This no doubt was true, because he valued his own judgment. His employees were hired to perform a particular function and not to become involved with the business of the of the bank. Wilmot Townsend, a bookkeeper, had saved $1,000 and approached Garitty to buy stock in the bank. Garitty asked him if he worked at the bank. When Townsend concurred, he was instructed to go back to bookkeeping and Garitty himself would select his stockholders. Garitty was known for his abruptness, but at the same time the customer always came first at his bank. He always gave wise counsel to his depositors and went out of his way to be helpful even when they did not heed his advice. He was always against people cashing checks, particularly large sums and keeping the cash, unless they were headed to a nearby merchant to pay a bill. Due to his encouragement, as late as 1910 customers of the First National Bank would add up bills at the first of the month and go to the bank and cash one check for the payment of bills. Never a socially minded person, Garitty met his social obligations once a year. Being a widower, he found this to be the easiest way to say thank you to his small circle of friends. He had married Emma Moore on June 15, 1870 while still residing in Calvert. A niece of the former Governor Moore of Alabama, she died February 17, 1893. After her death he entertained his guests with a meal at the Commercial or Maira Hotels or at Kiber and Cobb restaurant. Following the meal the guests were taken to the Merchants Opera House, founded by Garitty, for entertainment. It was not uncommon for several hundred people to make this social call. The Captain's social interest also extended to fraternal organizations, including Masons, Odd Fellows, Knights of Pythias and Elks. A member in good standing in all of the fraternities, he took much interest in Masonry of which he became a Knight Templar of the thirty-second degree and was a past Grand Commander of his state. He owned much valuable real estate within the city and was a promoter and stockholder of some of the city's leading industries and enterprises, including Corsicana Compress Co., the Texas Mill and Elevator Company, the Corsicana Manufacturing Company, the Corsicana Cotton Oil Company, and the street railway. He invested much of his money in city property and erected substantial buildings and improvements on it. As business flourished in Corsicana the First national Band did likewise. To date it has outgrown four locations. When first established by Adams and Leonard, the bank was located in a boxed house known as the Fundt Building on the corner of Fourth Avenue and Beaton Street. Later it was moved further south and across Beaton Street, relocating in 1915 on the corner of Beaton Street and Sixth Avenue. Its final move was in 1956 to its modern and larger banking facility on the corner of North Main and West Collin. The present structure was enlarged and remodeled in 1969. The bank became the first in Corsicana to own it own property. The building history of the location on Beaton and Sixth is most interesting. Wiley Clarkson, an architect from Fort Worth, was instructed to plan a six story bank building. When the plans were presented to the Captain for approval, he picked up his pen and drew through all the floor plans except the bottom two and reportedly said, "This is all I want." The Captain ordered the plans to provide him with a second story living apartment on the east end of the building facing Beaton. He maintained the apartment for several years before moving to the home of his nephew, Jim Nick Garitty, vice-president of the bank. The structure is still used for office suites and living apartments. It would be unfair to record the early banking success of Captain Garitty without including the influence of Huey. There is no doubt that Garitty ruled the bank with an iron hand, but Huey also made a romantic contribution. Upon the arrival of Garitty in Corsicana and the formation of the Garitty and Huey banking interest, Huey quickly became one of the most influential officers. He moved his hardware business to Dallas in 1879. Like Garitty, he was a pioneer of Navarro County, having move to Texas from Pennsylvania in 1851 and to Corsicana in 1871. His devotion to business and thoughtfulness in civic and charitable matters won respect for him among the citizenry. At the outset of the banking partnership, Huey was named vice-president, an office he continued to serve even after his move to Dallas and until his death. His banking experience in Corsicana with the First National Bank brought him the offices of director of the American Exchange National Bank of Dallas, then the largest banking institution in Texas, and president of the Mercantile National Bank in Dallas. At the time of his death at 77, Huey had become the wealthiest men in Navarro County. A fitting tribute was paid Huey by the R. G. Dun and Company upon his death: At Corsicana n March 29th, 1904 there passed away in the fullness of years and honors, one of Texas' pioneer citizens, Joseph Huey, a man who was a man and all that the term implies, whose life was a sermon on integrity, rugged honor and faith in his fellowmen. With the death of Huey, Garitty's nephew, James Nick Garitty, became vice-president. He was to serve the bank in some capacity over a span of 54 years, and on his retirement January 1, 1965, he was senior vice-president and trust officer. Business panics nor the echoes of war could dampen the spirits of First National patrons. When the panic of 1893 hit the nation's banking houses, Captain Garitty never failed to let the bank's customers withdraw their money from the bank. All national banks were ordered to allow only ten percent withdrawal of bank balance, but the Captain's policy was that a customer could draw out all of his money if he needed it. He personally had enough money in the bank vaults to underwrite the federal orders if questioned. Money was still tight in 1906-07. During these times and even dating back to the beginning of First National Bank mortgage loans reached to 24 per cent in interest, while the interest rate on prome loans rose to 18 per cent. Merchants felt the generosity of Garitty as he kept many of them from going broke. During World War I money once again tightened, and the federal government requested all banks to sell their gold. It is reported that Captain Garitty wrote out a check for $30,000 in order to hold the gold being held by the First National Bank. It is not known when the Captain personally sold the gold. Garitty was always concerned about the people of the community whether it was through a panic, a war or just normal times. Foremost in his wind was help for the poor. He established the Garitty Charity Fund to be administered only to the poor of Navarro County. The citizenry of Corsicana and Navarro County as well as people throughout the state were saddened on March 11, 1925 with the news of the death of Captain James Garitty. At his death the First National Bank had grown in capital from $10,000 to $300,000 and a surplus of $300,000 while total assets of the bank had reached nearly $3,000,000. The loss of Captain Garitty was keenly felt in the bank organization, but with the election of Joseph Napoleon Edens as the second president of the First National Bank, it continued to grow and prosper and increase in strength. When Edens joined the bank's organization, he was better known as "Pole", a nickname taken from his middle name, Napoleon. One of the best known stockmen and farmers in Texas, he was closely associated with the First National Bank before Garitty died, serving as director under Garitty. The Captain had hand-picked Edens on his ability and as a man with a vision. Edens spent much time in the bank from 1920 to 1925 because of the failing health of Garitty. This was Garitty's way of giving Edens insight into the affairs of the banking institution. It is evident that "Uncle Pole" fit the mold for the Captain. He shared the idea that the First National Bank should continue to grow into a strong banking institution. Characteristically, the two presidents possessed many of the same traits. Edens was another self-made man who possessed a broad education of experience and true knowledge, having left school about the eighth grade to manage his father's ranch after his father's death in 1902. Much of his experience and knowledge came from management of the ranch. Under his management, the ranch produced one of the finest show herds anywhere in the country. He began breeding Herefords in 1900, building a fine herd of pedigreed stock soon after the Herefords were introduced into the United States from England. His cattle were shown in Chicago and Denver and won numerous prizes throughout the nation for years. Edens combined his business ability with a love of the land and a keen interest in anything agricultural. This interest led to the formation of the famed "Edens Plan". He originated the plan under which First National made loans to farm boys for purchasing good beef cattle for feeding. A local plan at first, the "Edens Plan" was soon widely copied in East Texas and spread throughout the United States. Early in 1938, Edens put the plan in operation when he began financing 4-H clubs and Future Farmers of America chapters, and members were able to secure livestock loans for their beef cattle as well as any other type of farm project loan that won the approval of the County Agricultural Agent or any of the vocational agriculture teachers in Navarro County. The plan was unique and original in that each boy was encouraged to go to the bank without his father and handle his own loan arrangements. A mortgage was not taken on the calf or calves, and the father did not have to sign the note. The loans were made at four per cent interest and had to be repaid on or before November 1, 1938, after the boys exhibited their animals at the Corsicana Livestock and Agricultural Show (also founded by Edens) which was held on October 5-8, 1938. To provide protection to both the boys and the bank, group insurance was provided, which was included in the boy's notes. In addition, at times the boys had small loans to buy certain feed concentrates which were needed to supplement their home grown feed. During the first year of the program, some 53 Navarro County boys participated, but the success of the program was noted and adopted in 1939 in adjacent counties. Directors of the East Texas Chamber of Commerce adopted the program and recommended that all bankers and civic leaders in the 71 county area promote the "Edens Plan". By 1941, the plan had spread throughout the country and thousands of farm boys benefited, as banks across the nation began to copy the plan. Even today the influence of Edens' work is felt in 4-H club and FFA activities. First National Financed as many as 400 youths at one time and had more than $52,000 outstanding to minors without a parent signature. Dean and pioneer of the cattle industry in Navarro County, Edens founded and organized in 1938 the Corsicana Livestock and Agricultural Show, an organization that gave Corsicana one of the Southwest's finest fair and rodeo grounds and buildings. Edens served continuously as president from 1938 to 1955. Each year, visitors from all over Texas and other states attended the well known rodeo and fair. Edens worked hard on highway improvement in Navarro County and served in many capacities with the Corsicana and East Texas Chamber of Commerce, including director and president of both organizations. Keenly interested in research, he made his several thousand acre ranch available to early pasture improvement practices in Central and East Texas. Students from Texas A & M University for years paid annual visits to the Edens ranch to observe the practical application of scientific farming and animal husbandry at one of the state's finest cattle ranches and farms of cotton and grain. Edens was thought to be the first man in the Southwest to fatten cattle on cotton seed meal and hulls. Edens' banking experience and leadership won recognition among governors and presidents. In state affairs he was a member of the board of the Texas Big Bend Park Association and was selected as a member of the Texas Contact Committee of Reconstruction Finance Corporation for Texas during the depression. He was also appointed to the State Advisory Board of the Texas Citizens Committee for the Hoover Report to get Congress to pass recommendations to promote greater efficiency and reduce waste and duplication in the operation of the federal government. A few years after Edens became president of First National, the country was swept by one of the most severe depressions of all times. When banks throughout the country closed on March 5, 1933 for the three week moratorium or national banking holiday, Edens abided by the demand, but the bank's corridors were still astir with business. Merchants had so much faith in the bank that they continued to deposited their collected checks -- only checks could be written as no cash could be paid out by the banks until the end of the moratorium. To keep the bank strong, Edens was instrumental in getting the Central State Bank to merge with the First National in 1927 on the eve of the depression and then in 1931 the Corsicana National Bank merged with First National. Between the mergers financial history was written in Corsicana on January 14, 1930. On that date First National increased its surplus $150,000 to make $500,000 in surplus. This action was taken by the directors as requested by Edens to make the bank a million dollar institution -- a dream that came true too late for founders Garitty and Huey. In addition to the $500,000 in surplus the bank showed a capital of $500,000 and undivided profits of $44,000 to exceed the million dollar mark. The bank's strength continued to be built upon during all of Edens' tenure as president as he refused to pay dividends. By keeping all the bank's resources within the bank, Edens believed that the bank could continue a healthy growth. Indeed, the growth did continue and in 1942 when Edens retired, the bank's resources had almost tripled from $4,657,856.54 in 1925 when he became president to $9,150,532.35 upon his retirement. After his retirement as president, Edens continued to serve as a director and chairman of the board. He continued to serve as a director and chairman of the board. He continued to be active until 1968 when he sought full retirement. Today, he is honorary chairman of the board and resides on his ranch three miles southeast of Corsicana, with his wife, Macie Moore Edens, whom he married in 1902. With the retirement of Edens, Bascm Lynn Sanders Sr. became the third president of the First National Bank. He joined the bank's organization with a strong healthy record, having served as president of the Liberty National Bank of Dawson and the First National Bank of Coolidge. With his prior banking experience, he was abe to guide the bank in its second largest growth period. The resources of the bank under Sanders jumped from $9,150,532.35 in May 1942 when he became chief executive to $20,084,962.93 at his death in July of 1961. A native of Limestone County, near Coolidge, Sanders was not a newcomer to Corsicana when he joined the bank. Earlier in 1932 he moved from Hubbard to Corsicana and became associated with the Federal Land Bank Association of Coriscana (formerly the National Farm Loan Association), and was still serving the institution as director at his death. Known for his banking ability, he also served as a director of the Farm Credit Administration of Houston for 24 years and served for years as a director of the Federal Intermediate Credit Bank at Houston. A graduate of Hubbard High School, he attended Southwestern University at Georgetown for three years and then was graduated from Tyler Commercial College. Following his graduation he launched his banking career with the Farmers National Bank at Hubbard (later the First State Bank). In February 1921, he left his position as cashier of the First State Bank and became president of the Liberty National Bank at Dawson. When the Liberty and First National Bank in Dawson consolidated, Sanders became president of the First National, and later served as chairman of the board. Before his arrival in Corsicana he also served as president of the First National Bank in Coolidge for many years. A civic minded citizen, Sanders was a Navarro County director for the Savings Bond campaigns for several years and was active in Chamber of Commerce activities, serving as treasurer and director for a number of years. He was a friend to the farmers and ranchers as he actively sought all farming and ranching improvements. Interested in soil conservation, he headed a campaign for the Navarro County citizens to vote a two-cent maintenance tax for the detention lakes and ponds in the soil conservation program for the Trinity River Authority, Navarro Mills, and other conservation projects in the area. He also served as director of the Garitty Charity Association, Trinity River Improvement Association, and Corsicana Industrial Foundation. He was very active in Corsicana Country Club activities. He was vice-president and director of the Corsicana Agricultural and Livestock Association, trustee and member of the official board of First Methodist Church of Corsicana, and was a member of the advisory board of the University of Dallas. Another milestone of the First National Bank was reached under Sanders on Tuesday, Feb 14, 1956, when the stock holders voted unanimously to split the stock 10-1, revealing a stronger financial institution. The action was termed a constructive and forward step. Under the new move the 5,000 old shares were split to 50,000 shares of $10 value each and new stock certificates issued to owners. The First National Bank under Sanders eyed the growth of Corsicana and Navarro County, and to keep abreast of the growth, he was instrumental in getting the bank to build a more modern and complete banking facility. In December 1956 the First National Bank moved into one of the finest new banking houses and office buildings in the nation at the corner of North Main and West Collin Streets. Perhaps following the tradition of the First National Bank's executives, Sanders also became one of the best known bankers of Texas. His vision of the potential growth of the city and the bank paralleled. Even in his late years he was energetic and forceful with the bank's policies. At the age of 73 he suffered a severe heart attack and died in Navarro County Memorial Hospital in Corsicana July 29, 1961. With the death of Sanders, the directors began an extensive search for a capable replacement. The search ended just three months later when all directors attested that they had found the right man to lead the First National Bank into another new era of growth and prosperity. Answering the guidelines as set forth by the directors was W. D. Wyatt, Jr., executive vice-president of the First National Bank of Paris, Texas. Wyatt became only the fourth president in the long 90 year history of the First National Bank in 1961. Since the time Wyatt became president, November 6, 1961, the bank's resources have more than doubled, according to closing figures on June 30, 1971. In 1961 the resources had reached $20,084,962.93, but under Wyatt's ten year tenure as president, the bank has enjoyed its best growth period ever, reaching the $45,760,740.79 mark with the closing of the bank's books last December 31. Born in Wanetta, Oklahoma and educated in the Hugo Public Schools and Oklahoma State University with degrees in both agriculture and economics, Wyatt entered the banking field in 1956 as vice-president of the Citizens National Bank of Hugo, where he remained in the position until he resigned to become executive vice-president of the First National Bank of Paris. He continued in this position until November 1961 when he became president of First National. Immediately following the completion of his education at Oklahoma State University, Wyatt worked with the AA (now ASC) in Hugo and served some ten years as one of four members of the Oklahoma Board of Agriculture, a board responsible for agricultural programs and policies in Oklahoma. A ranch owner, with properties near Hugo, Wyatt became such a well known agriculturalist that he was selected in 1956 to spend one month in Russia with an agriculture commission group, one of the first to enter Russia following World War II to study farming conditions. In 1964, Wyatt added a new farm and ranch department to the First National Bank's organization in order to be of further service to the community. Currently Wyatt is a member and past chairman of the Industrial Committee of the Corsicana Chamber of Commerce. He has been instrumental in getting a number of industries to locate in the business community. He was responsible for the establishment of the first industrial foundation in Southeast Oklahoma. Like his predecessors, Wyatt has been active in civic and community affairs since coming to Corsicana. A past president of the Navarro County United Fund and the Chamber of Commerce, he is also past president of the Corsicana Country Club. He is a director of the Rotary Club and Salvation Army, as well as vice-president and director of the YMCA and director and chairman of the board of the Citizens National Bank in Ennis. A promoter of church activities, Wyatt is a steward and chairman of the board of trustees of First Methodist Church of Corsicana. Since becoming president of First National, Wyatt has led the bank in greatly expanding the services to the community within the past ten years. In order for the services to be increased the bank's stockholders in October 1963 formed Cornavco, an affiliate corporation held in trust for the benefit of the stockholders. Through the affiliate, stockholders own interest in three area banks -- Citizens National Bank in Ennis, Citizens State Bank in Malakoff, and the First National Bank in Streetman. Interest in Oceola, an Arizona charter credit life insurance company provides a complete travel agency, and holds oil properties plus numerous other investments. The modern banking organization today offers a complete line of banking services to its customers. In addition to the traditional checking and savings accounts and a few types of loans, it provides trust services, safe deposit boxes, drive-in-windows, a night depository, Master Charge, bank by mail, travelers' checks, cashier's checks, letters of credit and foreign exchange. The Transit Department can handle distant affairs quickly and efficiently to any part of the United States. Even the women's liberation movement cannot contest the bank's policy of keeping up with changing times as two women -- Mrs. J. E. (Kate) Whiteselle, a vice-president and director, and Mrs. H. G. (Genevive) Johnston, a director -- held key bank positions some 30 to 40 years ago at a time when it was unusual for women to be included in a bank's organizational structure. Today some four women hold important responsible positions in the bank's organization. In September 1969 the bank began its service operation by computer, eliminating the use of the outdated posting machine. In 1927, the bank's business had increased to the point that it was impossible to keep up with daily transactions by handwriting everything in the bank's ledgers, the method used since the founding of the institution in 1871. at that time it was necessary to begin the use of the posting machine. By 1969, the bank has expanded its loan service to include a separate mortgage loan department for real estate, having started handling FHA and VA loans. In 1964 the farm and ranch department was added to insure financial backing for farmers and ranchers. Recently the bank had a record $22 million in loans in 1970, as compared to less than $500,000 at the turn of the century and less than a million as late as 1943. By 1964, the bank had outgrown its four story structure completed in 1956 and underwent a massive expansion program to add three more floors in order to further fulfill the bank's purpose to render every financial service to Corsicana and the area. Included in the expansion was the trust department, which has become one of the largest in the state. Since the bank was granted trust powers in 1931, the department has entered a board spectrum of trusts to provide a valuable service to its customers. Supervised by the Trust Committee, the department under Oliver L. Albritton Jr., senior vice-president and trust officer, supervises investment of all trust funds and is authorized under law to act as administrator of estates, executor under wills, trustee under trust instruments. Personnel has been increased from two part time to 13 full time workers in order to offer this full line of trust services. At present the department manages some 225 active accounts with assets valued around $40 million. It is perhaps fitting that Captain Garitty was the "Father of Philanthropy" in Navarro County by establishing a $100,000 trust to benefit the county's poor. His influence has been felt in the community as other concerned citizens have followed Garitty in establishing other trusts. Frank Neal Drane, Bessie D. Hofstetter, Katherine Carmody, Jim Collins, Garland Rhoads, Jake Hudson, Robert Tatum, Blanche Terry and Irene Fleming have left all or a portion of their estates in trust so that the income derived there from can be used for worthy community and area causes. Most of these philanthropists or the foundations which they created have appointed the Trust Department as trustee or agent for the management of these assets. The community benefits mostly from the income of over $10 million in charitable funds held by these various trusts and foundations, with many of them specifically designating recipients. For example, the income from the Jim Collins Educational Fund goes specifically to provide scholarships for the graduates of Corsicana High School, while others, such as the Robert Tatum, give only general guidelines to be followed by the trustees in distributing income to provide comfort for the "indigent poor of Navarro County." Some individuals, such as Mrs. Carmody or Mrs. Terry, have left current income from the trusts they created to living friends or family members and have designated various charities as remainder beneficiaries. In some instances, the Trust Department is charged with the responsibility for deciding how the income will be used within very broad guidelines set up by the creator of the trust. One trust is this category which had the most significant impact on the community for the longest period of time is the Bessie D. Hofstetter Trust. This estate came under the jurisdiction of the Trust Department in the early 1930's with instructions to use a significant portion of the yearly income toward "the relief of poverty without regard to race, color, sex, or religious belief" and to "make loans to ambitious and worthy boys and girls who are financially unable to secure an education and would otherwise be deprived thereof." Through the years this trust has grown under wise management, and today it is in excess of $2 million with a distributable income of around $80,000 per year. Back of the long, proud history of the First National Bank has been a happy family of workers. Starting with only a handful of workers in 1871, the institution now employs 75 personnel members to carry on the bank's services. A trademark of the bank has been the faithful service of key personnel, as it is not uncommon for an employee to retire at the age of 65 with more than 40 years of experience with the bank. Much of the bank's strength has come from such employees as J. E. Butler, auditor (1956-69); John H. Brown, assistant cashier (1931-65); Charles W. Croft, assistant cashier (1920-63); George Dewberry, custodian (1931-67); J. N. Garitty, senior vice-president and trust officer (1910-64); F. L. Lindsey, assistant cashier (1921-64); J. O. McSpadden, vice-president (1943-65). As an inducement to keep the bank family, a retirement program was instituted in 1967 for members of the staff. Synonymous with the bank's growth has been a band of outstanding private and business accounts customers. Recorded in the annals of the bank's ledgers are the Corsicana Cotton Mills, playing an important role for many years in the economy of the city and county; the Magnolia Oil Company, which was organized in Corsicana; Texas Oil Company; Royal Coffee Company; and Sanger Bros., now Sanger-Harris of Dallas, which was located in Corsicana during the early days of the city. Private accounts have included such prominent people as Bob Smith, Houston oil man reportedly worth over $100 million, who started his career in Corsicana; Beauford Jester, Corsicana's own Governor of Texas; Roger Q. Mills, pioneer statesman; Luther Johnson, U.S. Congressman; Robert C. Jackson Jr., attorney and former state representative; and a number of Navarro County pioneers, including J. A. Townsend, operator of a private school; S. A. Pace, wholesale grocer, Drank Drane, philanthropist of the Navarro Community Foundation; William Croft, prominent local attorney; and Jim Collins, a bank director who set up a $2 1/2 million scholarship fund for local high school graduates. As the fist one hundred years closes and the second begins for the First National Bank, it will have a proud record to defend. One hundred years of continuous service is a record shared by just a few banks in Texas. Even through hard years, the bank's deposits have shown yearly increases. Deposits have grown from just a few thousand dollars in 1871 to well over $35 million in 1971, while during the same period the total resources have jumped from just over $10,000 to nearly $47 million. During the centennial year, the directors will give much study to a new proposed second hundred years. Already after much deliberation, the directors have proposed a reorganization of the bank into a bank holding company in order to allow the institution to broaden its base of community service. This will involve the formation of a new company, First Bancorp, Inc. and a merger of the bank into a banking subsidiary of the new company. Under the terms of the proposal, which was presented to stockholders for approval last February, the stockholders of the bank would receive stock in the new company in exchange for their present holdings at the rate of one share of the bank. As a result of the proposed reorganization, the bank would be converted into a bank holding company. As the First National Bank celebrates its centennial year, it no doubt will rededicate its banking philosophy for a second one hundred years. Starting as a small private bank founded by Captain Garitty and Joseph Huey, the institution immediately formed a strong banking house and has continued strong through oil booms and good times as well as economic panics and wars. By withstanding all types of crises and by meeting the challenges of the community to be a full service bank, The First National Bank is most definitely "the old reliable", while progress will be her byword into the future to continue to record a proud history. Corrections (1) I would like to submit a correction to an article posted on the Navarro County GenWeb. The link below is for an article entitled, ďThe First National Bank of Corsicana, Navarro County, Texas; written by a Herchel Stephens. Capt. James Garitty (my g-g-Uncle), was indeed a Capt. of Artillery, but in the Army of Northern Virginia, not in the Army of Tennessee, which was engaged at the Battle of Chattanooga. The James Garrity (two rís) identified on the Lookout Mtn. plaque was from Alabama and of no relation to the James Garitty of Corsicana/New Orleans. I first thought years ago that he might be related, but no such luck; a different line entirely. Census and other records pre/post war bear this out. Iíve run across several people attaching this individual to our family line erroneously and would like to see it corrected if possible, or noted that it is in error. Thank you in advance, Lyle Garitty Notes:

|

mercantile and banking business at terminal points along the Houston and Texas Central Railroad. Within five years his clerking ability was recognized and he was taken in as a business partner of two businesses along the H & TCR. As the railroad line crawled northward through Brazos, Robertson and Limestone counties, Captain Garitty became successful in his business enterprises and amassed between $10,000 and 12,000, which became the basis of his large fortune in later life. The Captain said it was "through good fortune" that he became a business success at an early age, but his beers attributed it to industry and good management.

mercantile and banking business at terminal points along the Houston and Texas Central Railroad. Within five years his clerking ability was recognized and he was taken in as a business partner of two businesses along the H & TCR. As the railroad line crawled northward through Brazos, Robertson and Limestone counties, Captain Garitty became successful in his business enterprises and amassed between $10,000 and 12,000, which became the basis of his large fortune in later life. The Captain said it was "through good fortune" that he became a business success at an early age, but his beers attributed it to industry and good management.